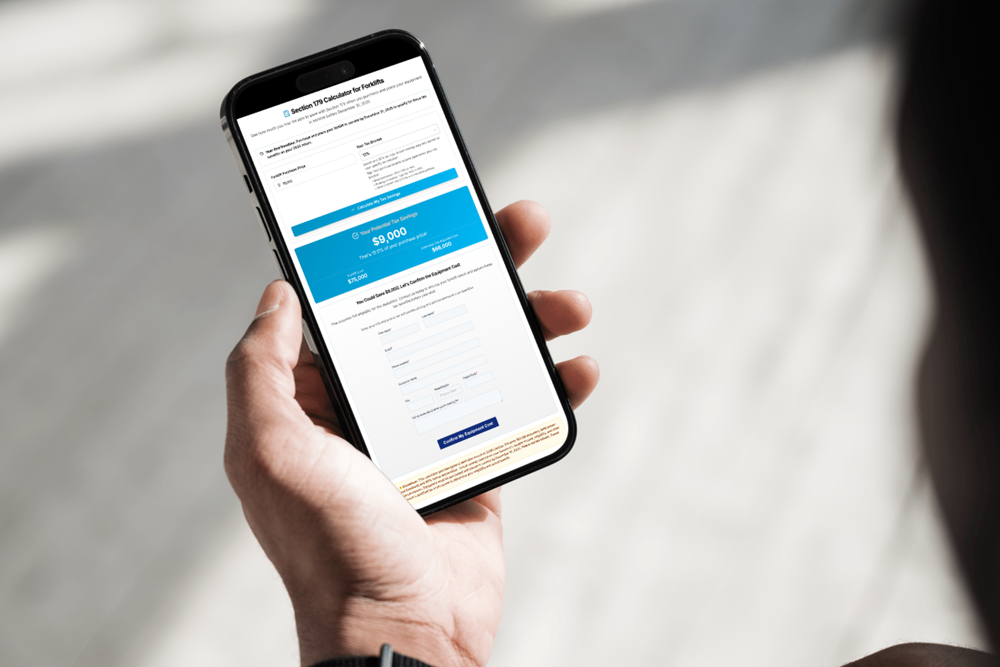

Section 179 Calculator

The 2025 tax law may let you deduct up to $2.5 million in qualifying forklifts, racking, and warehouse upgrades.

Estimate My Tax Savings

Limits Doubled

The tax deduction limit increased to $2.5 million, giving businesses potential room to invest.

New & Used

Applies to both new and used equipment, including forklifts, racking, and warehouse gear.

Act Fast

To take advantage you must have purchased and placed equipment in service by the December 31.

Lower Taxes

This deduction may reduce your taxable income, potentially improving cash flow and ROI.

What the 2025 Tax Law Could Mean for You

These potential benefits are based on IRS Section 179 and bonus depreciation rules. Always confirm eligibility and deductions with your tax professional.

Deduction Limit

Potentially deduct up to $2.5 million in qualifying purchases.

Used Equipment

Section 179 applies to both new and used qualifying equipment.

Bonus Depreciation

Businesses may also claim 100% bonus depreciation in 2025.

2025 Deadline

To qualify, equipment must be placed in service by Dec 31.

Eligible Equipment

Forklifts, racking, and warehouse gear may be eligible.

Financing Allowed

Financed purchases may still qualify for the full deduction.

Tax Reduction

The deduction may help reduce your 2025 taxable income.

Cash Flow

May improve year-end ROI and liquidity for your operation.

Estimate & Confirm Eligibility

Not sure what qualifies? That’s okay. Use our free Section 179 calculator to get a ballpark idea of what your potential tax deduction could look like. It takes less than 30 seconds and helps you plan your purchase with more clarity and confidence.

Once you have an estimate, talk to your accountant or tax professional to confirm eligibility and ensure you meet IRS requirements.

If you're unable to place equipment in service by December 31, 2025, Section 179 will still be available in 2026, with potential updated limits and terms.

We'll Help You Upgrade Smarter

From first quote to long-term service, we help warehouses grow stronger, safer, and more efficient, backed by a century of experience.

With over 100 years serving warehouses across the Mid-South, The Lilly Company knows how to keep operations running at full speed. We provide personalized guidance and deep expertise.

Whether you're planning an warehouse upgrade or exploring Section 179 savings, we’re here to make the process easy.

We proudly serve 14 locations across Tennessee, Mississippi, Arkansas, Alabama, Missouri, and Georgia.

Estimate My Tax Savings

"We've had a relationship with Lilly for 20 years. Of the material handling companies we deal with, Lilly is by far the better company. They've been around the longest and provide the best service. Brad Gregory has always done everything he could do for us."

Brent Noah

Director of Facilities at Viking Range

"Working for the government, it is important to be a good steward of taxpayer money. The Lilly Company makes recommendations I would never think of. That's why they are my go-to solution for forklift, material handling equipment, and services. I highly recommend rental from The Lilly Company!"

Private Government Agency

"The Lilly Company has partnered with us on many different racking layouts. They are great at laying out a racking plan to help you achieve your goal, and they work with you from start to finish. The installers are quick, accurate, and easy to work with."

Derrick Bristol

Sr. Warehouse and Logistics Manager

FREE DOWNLOAD

Need to buy a forklift but not sure where to start?

Sorting through all the options can be very time-consuming.

Don’t second-guess whether you’re purchasing the right forklift. Download your free copy of How to Choose the Best Forklift for Your Needs and Budget.